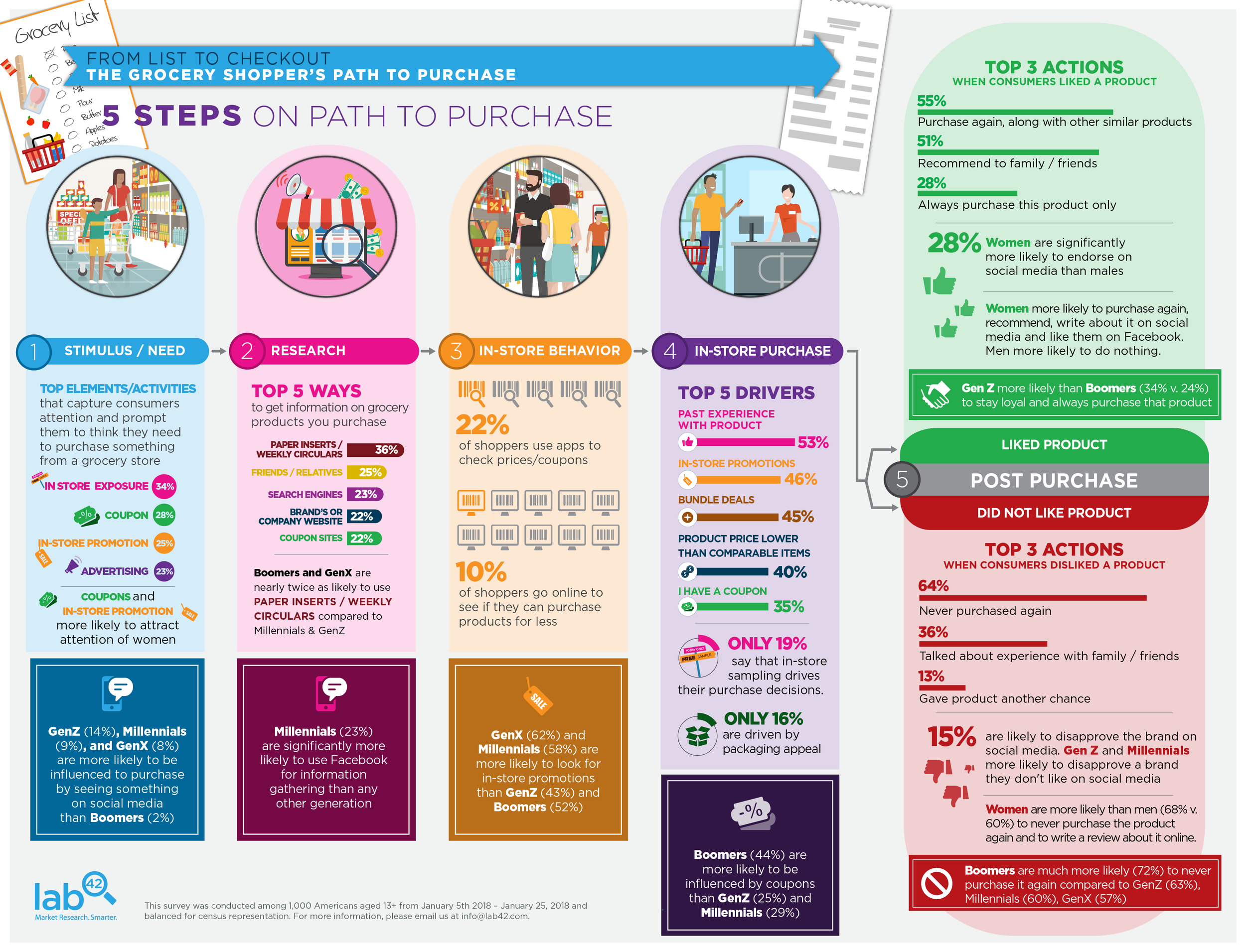

GROCERY SHOPPER PATH TO PURCHASE

The consumer’s path to purchase – the steps that are taken both pre-purchase and post-purchase – has been studied profusely as it helps marketers understand the everchanging influences on shoppers.This topic interested us here at Lab42, and we conducted Path to Purchase studies across several industries - including grocery, retail and electronics. This first infographic highlights the purchase influences on grocery shoppers, as well as similarities and differences across generations.Stimulus

Top elements/activities that capture consumers attention and prompt them to think they need to purchase something from a grocery store:

In store exposure

Coupon

In store promotion

Advertising

Coupons and in-store promos more likely to attract attention of females, while for males ads or direct requests from family and members.

GenZ, Mill and Gen X are more likely to see something on social media or read reviews online

Research

Top 5 ways to get information on products you purchase

Paper inserts / weekly circulars (36%)

Friends / relatives (25%)

Search engines (23%)

Brand’s or company’s website (22%)

Coupon sites (22%)

Boomers and GenX are nearly twice as likely to use paper inserts / weekly circulars compared to Millennials & GenZ, but GenZ & Millennials are nearly twice as likely to use Search Engines than the older generations.

Millennials are significantly more likely to use Facebook for information gathering than any other generation.

In-Store Behavior

Top 3 in-store behaviors

Look for in-store promotions (54%)

Compare prices for several similar products (51%)

Only purchase items on shopping list (31%)

Women are much more likely to look for in-store promotions & use an app to check prices/coupons than men

Men are significantly more likely than women to only purchase items that are on the shopping list.

GenX & Millennials are more likely to be driven by in-store promotions than GenZ or Boomers.

Purchase– What actually impacts your decision on what products to buy?

Top 5 Drivers

Past experience with product (53%)

In-store promotions (46%)

Bundle deals (buy 1 get one free, etc) (45%)

Product priced lower than comparable items (40%)

I have a coupon (35%)

Only 19% of grocery shoppers say that in-store sampling drives their purchase decisions.

Only 16% of shoppers are driven by packaging appeal, with Boomers least likely to be influenced by packaging (6%)

Women are more likely than men to be driven by cheaper options; coupons; in-store promotions and instore sampling

Post purchase – liked product

Top 3 actions

Purchase again, along with other similar products (55%)

Recommend to family / friends (51%)

Always purchase this product only (28%

Women more likely to purchase again, recommend, write about it on social media and like them on FB. Men more likely to do nothing.

GenZ more likely than Boomers (34% v. 24%) to stay loyal and always purchase that product

Post purchase – did not like product

Top 3 actions

Never purchased again (64%)

Talked about experience with family / friends (36%)

Gave product another chance (13%)

Women are more likely than men (68% v. 60%) to never purchase the product again and to write a review about it online.

Boomers are much more likely (72%) to never purchase it again compared to GenZ (63%), Millennials (60%) and GenX (57%).

Only 6% of Boomers would give the product another chance

Please feel free to reach out if you would like the full report on the Grocery Shoppers' Path to Purchase.